Expiring Federal Tax Credit for EV Purchases Will Dampen EV Adoption According to AutoPacific Data and Insights

The latest data and forecast EV sales from AutoPacific reveal the considerable impact of the upcoming elimination of the Federal tax credit.

The EV market in the U.S. is headed for a rough patch with market share growth stalled due to multiple factors related to lack of affordability.”

LONG BEACH, CA, UNITED STATES, August 19, 2025 /EINPresswire.com/ -- The latest data and forecast EV sales from noted automotive market research and consulting firm AutoPacific reveal the considerable impact of the upcoming elimination of the Federal tax credit. The recent passing of H.R.1, the One Big Beautiful Bill Act of 2025, includes the elimination of the Biden-era Federal tax credit for EV purchases and leases that can currently save the consumer up to $7,500 off the purchase price of a full battery electric vehicle, plug-in hybrid vehicle, or hydrogen fuel cell vehicle. The impact of the repeal, which goes into effect after September 30, will no doubt be consequential as it effectively raises the cost of EVs significantly, making them less affordable to many interested shoppers.— Ed Kim, AutoPacific President and Chief Analyst

Data from AutoPacific’s newly released 2025 Future Vehicle Planner show that about a third of new vehicle shoppers who would consider an EV as their next vehicle say that they are very aware of the tax credit and would buy or lease a new EV because of the tax credit. This represents a 2%-point increase over 2024. Furthermore, awareness of the soon-to-expire tax credit is greater than last year, with 79% of EV considerers in 2025 saying they are aware of the tax credit, compared to 75% in 2024.

The elimination of the tax credit comes at a particularly unfortunate time for the upcoming wave of what were to be affordable EVs. AutoPacific’s Future Vehicle Planner data have shown year after year that affordability is one of the biggest barriers to EV adoption, with 32% of EV rejectors in 2025 saying the cost to purchase or lease an EV is too expensive and 35% saying lower vehicle prices would make them reconsider. Automakers responded to this with a spate of affordable EV models launching over the next few years, but unfortunately, these models will no longer benefit from the tax credit, and most if not all of them will also be impacted by tariffs either on the vehicles themselves, or their parts and materials.

As such, AutoPacific expects EV adoption rates to flatten considerably as the price of entry into the EV market increases by as much as $7,500 just on the elimination of the tax credit alone, even without accounting for other increased costs stemming from recently imposed tariffs on imported vehicles, parts, and raw materials. AutoPacific’s President and Chief Analyst Ed Kim says, “The EV market in the U.S. is headed for a rough patch with market share growth stalled due to multiple factors related to lack of affordability. Consumer awareness of the Federal tax credit for EV purchases and leases as well as intent to buy an EV because of it have grown since 2024, but consumers interested in one will soon find them significantly less affordable.”

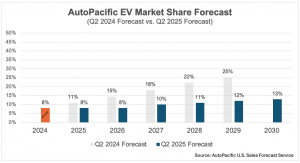

AutoPacific’s Sales Forecast Service’s newly updated U.S. EV forecast calls for 8% EV market share in 2025 and 2026, the same as in 2024. Without continued tax credits, AutoPacific now expects EVs to reach about 12% market share in 2029, significantly down from AutoPacific’s EV forecast from a year ago of 25% market share by 2029. “Consumers who are interested in acquiring a new EV may do well to start shopping soon, before the Federal tax credit expires after September 30,” says Kim.

About AutoPacific

AutoPacific is a future-oriented automotive marketing research and product consulting firm providing clients with industry intelligence and sales forecasting. The firm, founded in 1986, also conducts extensive proprietary and syndicated research and consulting for auto manufacturers, distributors, marketers, and suppliers worldwide, including its highly recognized Future Vehicle Planner and Future Attribute Demand Study (FADS). The company is headquartered in Long Beach, California with affiliate offices in Michigan, Wisconsin, and the Carolinas. Additional information can be found at http://www.autopacific.com.

Deborah

AutoPacific, Inc.

deborah.grieb@autopacific.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.